Double Calendar Spread Bank Nifty Low Capital & Zero Adjustments

LEAPS calendars are just like standard calendars, except that the back-month long option is a LEAPS (Long Term Equity Anticipation Securities) whose option expiry is at least a year out in time. Because we are buying so much "time" upfront, we want a low price when implied volatility (IV) is low.

Pin on Double Calendar Spreads and Adjustments

A calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same strike price. Calendar.

Pin on Double Calendar Spreads and Adjustments

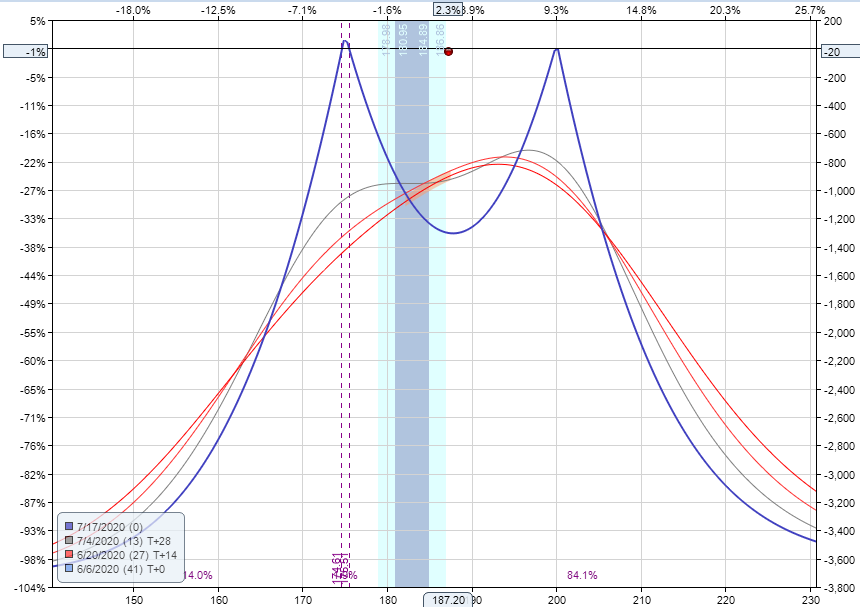

A put-based calendar spread is created below the current market, and a call-based calendar spread is created by selecting expiries above the current market. A double calendar spread is a debit strategy that has positive vega and hence, is created in a 'low-volatility environment'.

Pin on Double Calendar Spreads and Adjustments

10 10 0:00 / 13:50 Double Calendar Option Spread: Adjust Or Exit OptionGenius 3.91K subscribers Subscribe 51 15K views 11 years ago Options Calendar Spreads http://www.OptionGenius.com.

Double Calendar Spread Adjustments Pin on Calendar Spreads Options

A double diagonal calendar spread is an options trading strategy that involves the simultaneous use of both a diagonal spread and a calendar spread. This advanced strategy aims to minimize risk and maximize profits by taking advantage of options pricing dynamics, options volatility, and options Greeks. By combining these two strategies, traders.

Pin on CALENDAR SPREADS OPTIONS

How to Trade Calendar Spreads - The Complete Guide This is your complete guide to calendar spreads. In this episode, I walk through setting up and building calendar spreads, the impact of implied volatility and time decay, how to adjust and exit, and the best market setups for these low IV option strategies. View risk disclosures

Double calendar spread adjustments will be needed, in the event that

Explanation A double diagonal spread is created by buying one "longer-term" straddle and selling one "shorter-term" strangle. In the example above, a two-month (56 days to expiration) 100 Straddle is purchased and a one-month (28 days to expiration) 95 - 105 Strangle is sold.

Double Calendar Spreads Ultimate Guide With Examples Trasiente

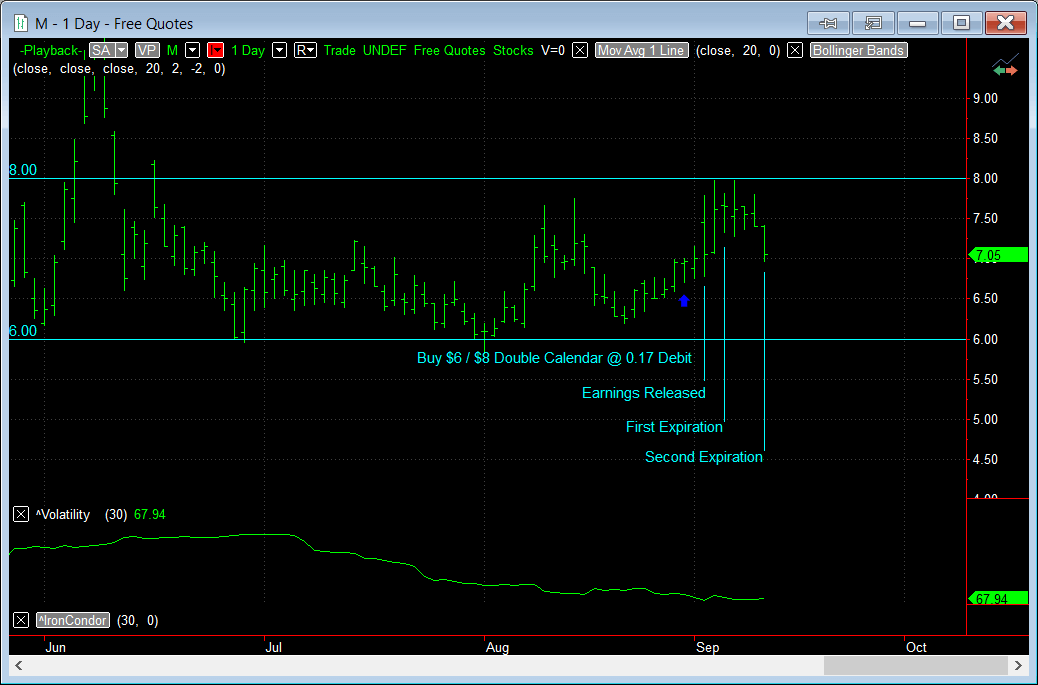

This article discusses how traders can earn side hustle income trading double calendar spreads. A double calendar spread is essentially just two calendar spreads with different strike prices.. This adjustment skews the spread in the same direction that the stock is moving (in this case, higher) and also reduces the risk for the spread in the.

Pin on Double Calendar Spreads and Adjustments

Calendar Spread | Double Calendar Spread Option Strategy and Adjustments - YouTube Calendar & Double Calendar Spread Option Strategy are the low risk and low margin.

Pin on Double Calendar Spreads and Adjustments

A double calendar spread is an option trading strategy that involves selling near month calls and puts and buying future month calls and puts with the same strike price. A double calendar has positive vega so it is best entered in a low volatility environment. Traders believes that volatility is likely to pick up shortly.

Double Calendar Spreads Ultimate Guide With Examples Trasiente

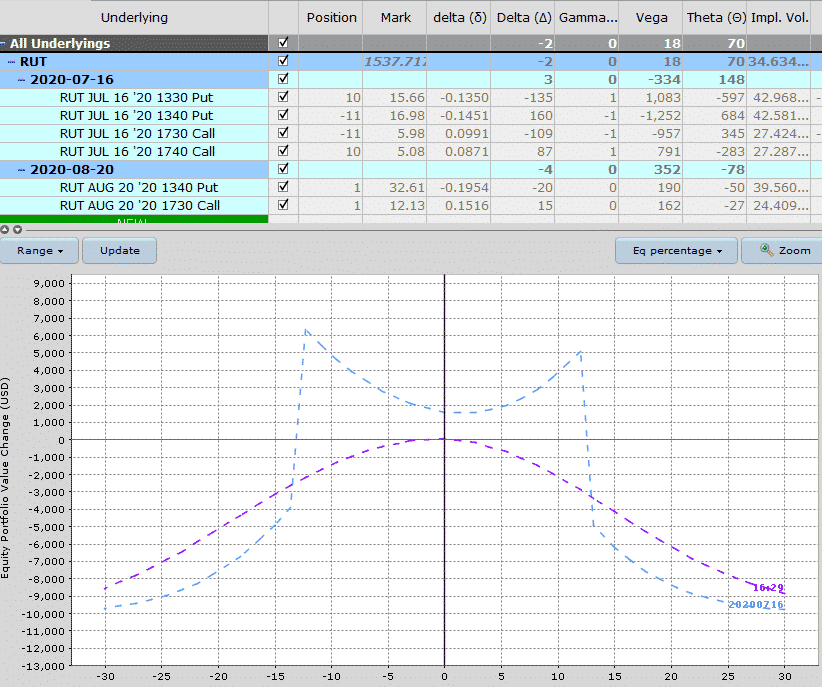

1) When in doubt, adjust the spread to either a vertical spread, or even consider closing it out. 2) Adjust from the short side first, covering the short side and then shorting the side.

Double Calendar Spreads Ultimate Guide With Examples Trasiente

1. Sell the lowest-strike calendar spread and buy a new calendar spread at a higher strike price, again checking with the risk profile graph to see if you are comfortable with the new break-even range that will be created.

DOUBLE CALENDAR SPREAD OPTION STRATEGY LIVE DEPLOYMENT,ADJUSTMENTS

Compared to the single calendar, a double calendar has wider break-even points to the upside and downside. But as the front leg's expiration date approaches, the risk profile forms a dip between two peaks.

Pin on CALENDAR SPREADS OPTIONS

Link to our Telegram Channel - https://t.me/niftybnLink to our Twitter Profile - https://twitter.com/NiftyBnIn the previous video titled "Double diagonal spr.

Pin on Double Calendar Spreads and Adjustments

A double diagonal spread is made up of a diagonal call spread and a diagonal put spread. It is a fairly advanced option strategy and should only be attempted by experienced traders, and as always, you should paper trade this for 3-6 months before going live. The double diagonal is an income trade that benefits from the passage of time.

Pin on Double Calendar Spreads and Adjustments

Double Calendar Spread - Rules Conclusion Compute the expected move for a stock by using the straddle price Look at the Implied Volatility of short term options versus long term options to find a ratio of 2-to-1 (short term IV twice the long term IV) Sell Short Term Calls and Puts while buying Long Term Calls and Puts, the.